At all times | August 2024 Update

"At all times, in all markets, in all parts of the world, the tiniest change in rates changes the value of every financial asset.” - Warren Buffett

Image generated by Gemini

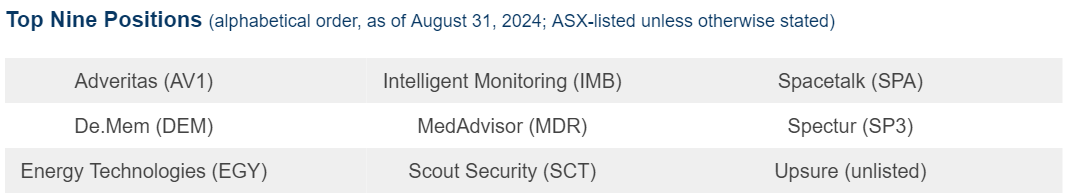

THE MONTH | No real surprises to be found among our investments during the ASX’s August profit reporting season but volatility certainly made a mark. The Fund’s negative return of -3.57% for the month largely reflected: a temporary dip in Intelligent Monitoring (IMB) that has since been recovered; a similar dip in MedAdvisor (MDR) that continued into early September before starting to recover ground; and a drop in a smaller holding, Opyl (OPL). Relevant indices were mixed in the month with the S&P/ASX Emerging Companies Index +1.85% and the Small Industrials -2.2%.

SMALL TALK | Since our last monthly update, Fund investors have received profiles of cybersecurity company Spectur (SP3) and MDR in our weekly Small Talk updates.

OUTLOOK | Speculative activity around short-term interest rates has seen heightened volatility in the bond market as well as equities. Rather than focus on the short-term gyrations, we look more at the implications for longer-term rates that represent the cost of capital. Amid all the short-term excitement over official US interest rate cuts last week, the Australian and US government ten year bond yields actually nudged higher - but they have moved lower over the past 12 months. We remain a long way away from the world of zero rates and do not expect a return to such territory but it is undoubtedly the case that lower interest rates should provide a supportive backdrop for smaller equities - as long as they don’t turn out to be indicative of impending recession. With or without that support we continue to see value and opportunity in the individual businesses held in the portfolio.

PORTFOLIO REVIEW

We generally have the view that there should be few surprises in the profit reporting season - which came and went in the month of August. Companies have disclosure obligations and in the case of many smaller companies they also have to report quarterly cash flow reports a month earlier that give you a good handle on what their financials look like.

Fund investors and friends of the firm can read our SmallTalk run-down of a dozen results at the tail end of reporting season. But here’s the stories behind the major moves in the portfolio for the month:

Family safety technology business Spacetalk (SPA; ~$11m market cap; +32% stock price change in August) said it was “on track to deliver $20m-$25m ARR business in 2026”, lifting ARR 17% to $9.7m in FY24.

Revenue grew 33% to $17.9m in FY24 and the EBITDA loss was reduced to -$3.4, from -$8.4m, including a cash flow positive June quarter.

SPA held $1.77m cash against $5m in borrowings at June 30 The company has since launched a $3.2m capital raising ($1.6m completed, $1.8m to follow in a rights offer, with $1m underwritten)

Disclosure: Equitable Investors’ Martin Pretty is a non-executive director of SPA.

Security monitoring company Intelligent Monitoring (IMB; ~$199m market cap;-9% stock price change in August) delivered FY24 numbers that pleased us, bettering its guidance. But the market did not get the chance to react to those earnings before month-end as they were announced on the last trading day and IMB’s shares spent that day halted from trade while its auditor made a last minute decision to add back tax losses to the balance sheet, now it has demonstrated it can generate earnings that will utilise those losses.

IMB reported normalised, pro-forma EBITDA of $34.6m versus guidance of $33.5m. It said operating cash flow, before non--recurring costs, was $20.8m (v. $17.9m guidance when ADT was acquired).

It then said early trading in the new financial year has been above the “upgraded” guidance of $40.2m pro-forma EBITDA.

It was a strange month on the ASX for MedTech MedAdvisor (MDR; ~$215m market cap;-12% stock price movement in August) as its price declined despite there being no surprises. Read our profile here.

FY24 revenue grew 25% to $122.1m, in-line with guidance of $120-123m. Gross margin improved and FY24 was MDR’s first profitable financial year, with EBITDA of $7.0m for $0.5m net profit.

MDR held $15.6m in cash at June 30, going into its peak cash generating half (December half) and also received a $3.5m expansion to its debt facility (that was not drawn - $12m was already drawn).

MDR is targeting $250m in sales by FY30, at a 20% EBITDA margin, based on ~15% annual organic growth and acquisitions.

Clinical trial AI company Opyl (OPL; ~$3m market cap;-43% stock price movement in August) is not one of our larger positions but it impacted NAV with a sharp share price decline accompanying a $700k debt raising for working capital. Since then, OPL, which leverages AI to assess the probability of clinical trial success, has announced a number of commercial agreements to utilise its “Trialkey” offering to both assess and optimise trials. Being of the view that historically there has been very little information to apply to the evaluation of drug discovery companies’ chances of success, we think Trialkey is a potential game changer.

WHAT’S ON OUR MINDS

Liquidity in small stocks

The activity level in ASX small stocks does appear to have stabilised after sharp declines in 2022 and 2023, based on our proxy measure, the value of trade in the S&P/ASX Emerging Companies Index. The month of August was the fifth consecutive month in which the value of trade increased year-on-year. But on a 12 month trailing basis, the value of trade remained down 5% year-on-year.

Private Market Valuations

Private markets continue to slowly adjust to reflect change in the cost of capital that has occurred over the past two years. Clearly not all is rosy in the world of unlisted VC, PE and “real assets” - and despite marketeers labelling private assets as low volatility, there is underlying volatility in the pricing of private assets AND correlation with public markets.

Private equity’s annualised IRR fell below 10% in the year to March 2024, according to PitchBook data cited by the Financial Times, compared to a target of 25%. Meanwhile, the Wall Street Journal reported in June on how stakes in private equity funds were being traded at “big discounts to the official values”.

In US secondary markets for VC investments, on average, the ZX Index Values for August 2024 showed a 16% decrease compared to the last round price per share.

Wilshire used an 11.9% decline in its Real Assets Benchmark for pension fund giant CalPERS in the year to June 2024 (covering real estate, infrastructure and forestland)

“Recap” risk and opportunity

Australasian equity capital raising activity strengthened in the June quarter - the dollar value raised of $US7.43 billion was the most in a quarter since September 2022. But IPOs remained scarce, other than Guzman Y Gomez. We analysed quarterly cash flow reports for the June quarter of 2024 and found over 262 companies with no more than four quarters of cash funding at hand based on their most recent burn rates - and also 95 companies in net debt positions that reported negative operating cash flow. With these companies competing for new capital, there is a funding risk for existing investments that are not self-funding at this stage. The situation is also an opportunity for investors to apply bottom-up, fundamental research and engage constructively with companies to provide them with capital on attractive terms.

Interest rates & inflation

Interest rates remain low by historical standards (see 700 years of declining rates charted here). Our view through the first half of CY2024 had been that there was not a strong case for reducing interest rates in the near-term and that if central banks do walk back rates materially, the implication will be that the economy has deteriorated. Increasing signs of softness in the economy has led the Federal Reserve to begin cutting rates in the US this month and other central banks may make some rate reductions. In Australia there remains more uncertainty regarding central bank policy. Shifting market sentiment regarding the extent to which interest rates could decline will influence the market in the short term.

Energy

We see energy as a quasi-currency - if you have energy you hold something valuable and exchangeable. The world is going to need all forms of energy to sustain or further advance standards of living. “Electricity demands from AI data centres are outstripping the available power supply in many parts of the world” already, Bloomberg has reported. Dragonfly Fund does not invest in the resources sector directly but we do own and seek out opportunities to participate in the energy economy - through engineering, manufacturing and software or other industrial and technological angles..

Unlisted

A key lesson for us from FY2023 is that it is important when investing in unlisted entities to have some form of influence. During FY2024 we realised one unlisted investment, in data centre cooling tech company Firmus, for a return equating to just under 20% a year.

Applications to invest in Equitable Investors Dragonfly Fund can be made online with Olivia123.

10k Words | September 2024

Liquidity in small stocks

Tech IPOs - there have been very few of them lately - but the unlisted world is bursting with “unicorns”. Now that the Fed has cut rates in September, what’s next? The market is not only oscillating around interest rate expectations but is also exhibiting volatility in the short time between the rate cut announcement and the press conference. We check in on PE multiples relative to historical levels by geography and sector, consider market moves in relation to risk premiums, then the performance of “AI” stocks. Finally we turn to the ASX’s recent reporting season and look at the average sector-based consenus revisions to nano-to-mid caps plus the stream of dividends flowing into investors’ accounts this month and next.

Dragonfly Fund has the capability to "swap" shares in a company or companies for Dragonfly Fund units where Equitable Investors finds them attractive and suitable investments. If you have a stock in your bottom drawer that we might be able to do something with, please reach out. NOTE to date we have used this capability sparingly, rejecting all but a very small number of proposals, but we continue to seek favourable opportunities.

Want to catch up?

If you are interested in learning more, please get in touch via mpretty@equitableinvestors.com.au and we will be pleased to arrange a meeting.