Time - September 2023 Update

“Investing is a business where you can look very silly for a meaningful period of time before you’re proven right." ― Pershing Square founder Bill Ackman.

THE QUARTER | The Fund recovered some ground during the September quarter (+2.01%) with a few M&A (mergers & acquisitions) catalysts contributing, along with a recovery for smaller stocks in July after absorbing tax loss selling in the prior quarter.

THE MONTH | Another short-term period where avoiding bad news was not enough to avoid broad-based declines in small “FIT” (Financials, Industrials and Technology) companies. Illiquidity cut both ways with the largest moves in our investments being on limited trading activity. Cirrus Networks (CNW) and Adveritas (AV1) were the strongest performers. Scout Security (SCT) and Spectur (SP3) were the weakest.

STOCK PROFILES | Since our last monthly update we have profiled marine propulsion and gyro manufacturer Veem (VEE) in our weekly SmallTalk updates for investors.

OUTLOOK | Liquidity - and by implication investor interest - remains poor for microcaps. In the month of September, our proxy measure, the value of trade in the S&P/ASX Emerging Companies Index, came in at the lowest level for that calendar month since 2018. Our view is that while even fewer investors are paying attention than historically has been the case, the long-term opportunity for smaller stocks is even greater. We cannot predict a short-term turning point in sentiment but the agreed sale of Cirrus Networks (CNW) during the September quarter serves as a reminder that if the marginal buyer is not interested, companies that are achieving objectives and demonstrating value will ultimately attract industry or financial acquirers.

Image: “Abstract pencil and watercolour art of a hawker in front of a market stall looking on as the crowd passed by ignoring him” - generated by DALL-E

PORTFOLIO REVIEW

Mergers and Acquisitions have been front and centre as catalysts for smaller stocks in this environment of low market activity.

IT consulting business Cirrus Networks (CNW; +43% in the quarter) agreed to be bought (via a scheme to be approved by shareholders) by fellow listed IT consulting firm Attura Holdings (ATA) during mid-September, with an initial takeover offer of $0.053 a share in cash and scrip later lifted to $0.063 a share. The revised offer represented a 53.7% premium to the last close prior to ATA’s initial bid. CNW’s scheme document puts the valuation of the offer at 11.1x FY23 adjusted EBITDA (pre-AASB 16). This level of valuation is consistent with the investment thesis we had set out, as per this profile in Small Talk, where we mapped out how we saw CNW following in the footsteps of previous holding Empired and other formerly listing IT consulting businesses that had been acquired over the years.

The other key contributor to the Fund’s quarterly performance was security monitoring business Intelligent Monitoring Group (IMB; + 28% in the quarter). In June IMB announced a transformational acquisition and funding restructure and, as we set out in the June update, we think there is plenty of scope for a further re-rating. IMB has bought ADT’s Australian security business and followed that up in recent weeks by acquiring 3,100 customers of “Securely” in New Zealand, at a price it said was 3x cash profit. IMB confirmed it is on track for its $31m annualised EBITDA target for FY23 following the acquisition of ADT. That’s on a market cap of $48m, with pro-forma net debt standing at ~$67m, implying an EV/EBITDA multiple of 3.7x We profiled IMB and the ADT acquisition here in Small Talk.

One that hasn’t been acquired yet - but has received an offer - is digital ad fraud protection play Adveritas (AV1; +7% in September), which was a positive contributor in the month of September. Back in November 2022, AV1 received a non-binding indicative offer of $0.11 a share from Nasdaq listed Integral Ad Science but the offer was not pursued by this tightly held microcap. We don’t expect AV1’s anti-fraud solution, TrafficGuard, is becoming any less appealing as it wins business. We profiled AV1 in Small Talk here.

The weakest spots in the portfolio were, consistent with the preceding commentary, stocks that have suffered from low liquidity and the resultant price volatility. Scout Security (SCT) was down 32% in the month of September after rallying 22% in August and falling 22% in July. Spectur (SP3) was down 17% in September, after a -4% move in August and a +26% rally in September. Neither company had any material news in September.

Portfolio Changes

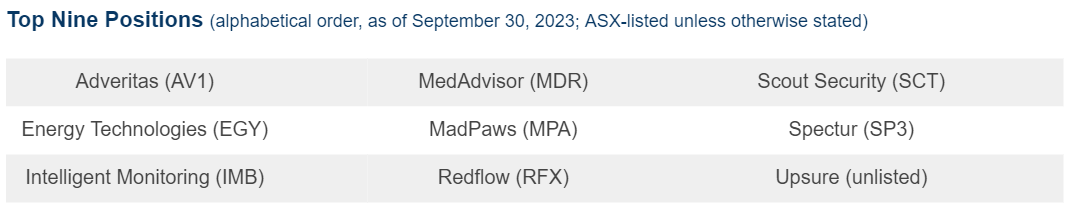

Since our August 2023 update, there have been two shifts in the Top Nine positions. We sold part of our holding in CNW after the ATA bid, while we opportunistically added to our position in Mad Paws (MPA; -2.2% share price change in the month) and participated in a shortfall placement in battery technology company Redflow (RFX), pushing 8Common (8CO; -1.3% share price change in the month) back out of this table.

WHAT’S ON OUR MINDS

Liquidity in small stocks

Year-on-year declines in the value of trade among stocks in the S&P/ASX Emerging Companies Index resumed a decline in the month of September, down 11%. The months of July and August 2023 had been the only two months in which a positive YoY change was recorded since April 2022. There was a 39% dive in the value traded in FY2023. Anecdotally, we think the decline in trading activity has been more severe for smaller companies not included in the Emerging Companies Index. For patient investors, such pull-backs in “the market” risk appetite for smaller stocks tend to create opportunities.

Private Market Valuations

News of “down-rounds” and corporate failures continues to flow. In the June quarter, US tech valuations were hit by a median 60% year-on-year decline for companies doing “Series D” or later funding rounds, CB Insights found. Series C companies faced a median 48% valuation drop and Series A & B companies faced into a 30% de-rating. One opportunity for listed companies is to acquire or emerge with unlisted businesses that can no longer hold out for high valuations. Data from ASIC, meanwhile, shows the number of Australian companies entering into external administration surged 62% in FY23. Similarly, in the US, data from S&P showed that there had been more bankruptcies in the first seven months of CY2023 than the entire CY2022.

“Recap” risk and opportunity

Australasian equity capital raising activity was down 40% year-on-year in the September quarter and was less than haf off the figure from two years earlier, using Dealogic data (in USD). We updated our analysis of ASX-listed cash burners following a recent round of quarterly cash flow reports. Nothing much has changed since we honed in on this theme a year ago: hundreds of ASX listings either have less than a year of cash on hand or do not generate enough earnings to cover their interest expense. Businesses are increasingly desperate for funding. This is a risk for existing investments that may require capital. It is also an opportunity and an exciting time for investors to apply bottom-up, fundamental research and engage constructively with companies to provide them with capital on attractive terms.

Interest rates & inflation

Interest rates remain low by historical standards and central banks should be keen to get back to something like the Taylor Rule estimate that an equilibrium policy rate is 2% above inflation. We do not see a strong case for reducing interest rates in the near-term and if central banks do walk back rates, the implication will be that the economy has deteriorated.

Energy

We see energy as a quasi-currency - if you have energy you hold something valuable and exchangeable. The world is going to need all forms of energy to sustain or further advance standards of living. Dragonfly Fund does not invest in the resources sector directly but we do own and seek out opportunities to participate in the energy economy - through engineering, manufacturing and software or other industrial and technological angles.

Unlisted

A key lesson for us from FY2023 is that it is important when investing in unlisted entities to have some form of influence.

Applications to invest in Equitable Investors Dragonfly Fund can now be made online with Olivia123.

Twitter

Tech Valuations Report Q2 2023 | CB Insights

The valuation component of this year’s sotck-market rally may be ending | @KoyFinCharts

The incredible rise of unprofitable companies | @KoyFinCharts

SP500 Equity Risk premia at 20-year lows | @EquitOrr

Venture Firms Still Writing Small Checks Despite $271 Billion in ‘Dry Powder’ | The Information

Dragonfly Fund has the capability to "swap" shares in a company or companies for Dragonfly Fund units where Equitable Investors finds them attractive and suitable investments. If you have a stock in your bottom drawer that we might be able to do something with, please reach out. NOTE to date we have used this capability sparingly, rejecting all but a very small number of proposals, but we continue to seek favourable opportunities.

Want to catch up?

If you are interested in learning more, please get in touch via mpretty@equitableinvestors.com.au and we will be pleased to arrange a meeting.