10k Words | July 2025

Valuations, revisions, interest rate expectations, the private capital liquidity problem & shifting sands in mortgage markets

Apparently, Confucius did not say “One Picture is Worth Ten Thousand Words” after all. It was an advertisement in a 1920s trade journal for the use of images in ads on the sides of streetcars...

We get a bit fixated on US equity valuations, with Vanguard highlighting the high hurdles required to achieve another decade of >12% returns; even as the 10 year bond yield has been more competitive and tariffs drive negative earnings revisions in the US. The Ex-US equities world has been fairing better out of the tariff scenario. We check in on interest rate expectations in the US and Australia. Bain bemoans a softer global buyout environment lately while The Information tackles the private market liquidity problem graphically. Finally, the US office CMBS delinquency rate charts near-vertical while Aussie mortgage arrears have been on the rise.

Total market cap of S&P 500 firms >10x Price/Sales (US$ trillion)

Source: Kailash Capital Research

Repeat of returns >12% for US equities requires record-high profit margins, record-high valuations, or a combination of both

Source: Vanguard

S&P 500 Price/Free Cash Flow (cap weighted and equal weighted) v index level

Source: Fidelity

US 10-year government bond yield

Source: FRED

Consensus S&P 500 earnings by calendar year

Source: Columbia Threadneedle

Forward 12-month global earnings forecasts & net balance of upgrades v downgrades

Source: Barclays Private Bank

% of companies with downwards earnings revisions & impact of tariffs

Source: Schwab

The rest of the world is ahead since Feb 19 - in common currency

US market still looking for a Fed Reserve cash rate cut in September - but not quite as sure as a week ago

Source: CME

Australian market backing in a 25 basis points rate cut by the RBA in July

Source: ASX

Global buyout deal value, by region ($US billion)

Source: Bain, Dealogic

Scarcity of opportunities to convert private investments into cash

Source: The Information

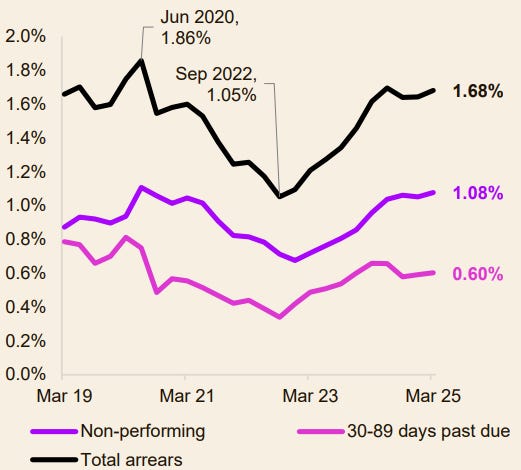

Australia mortgage arrears

Source: cotality

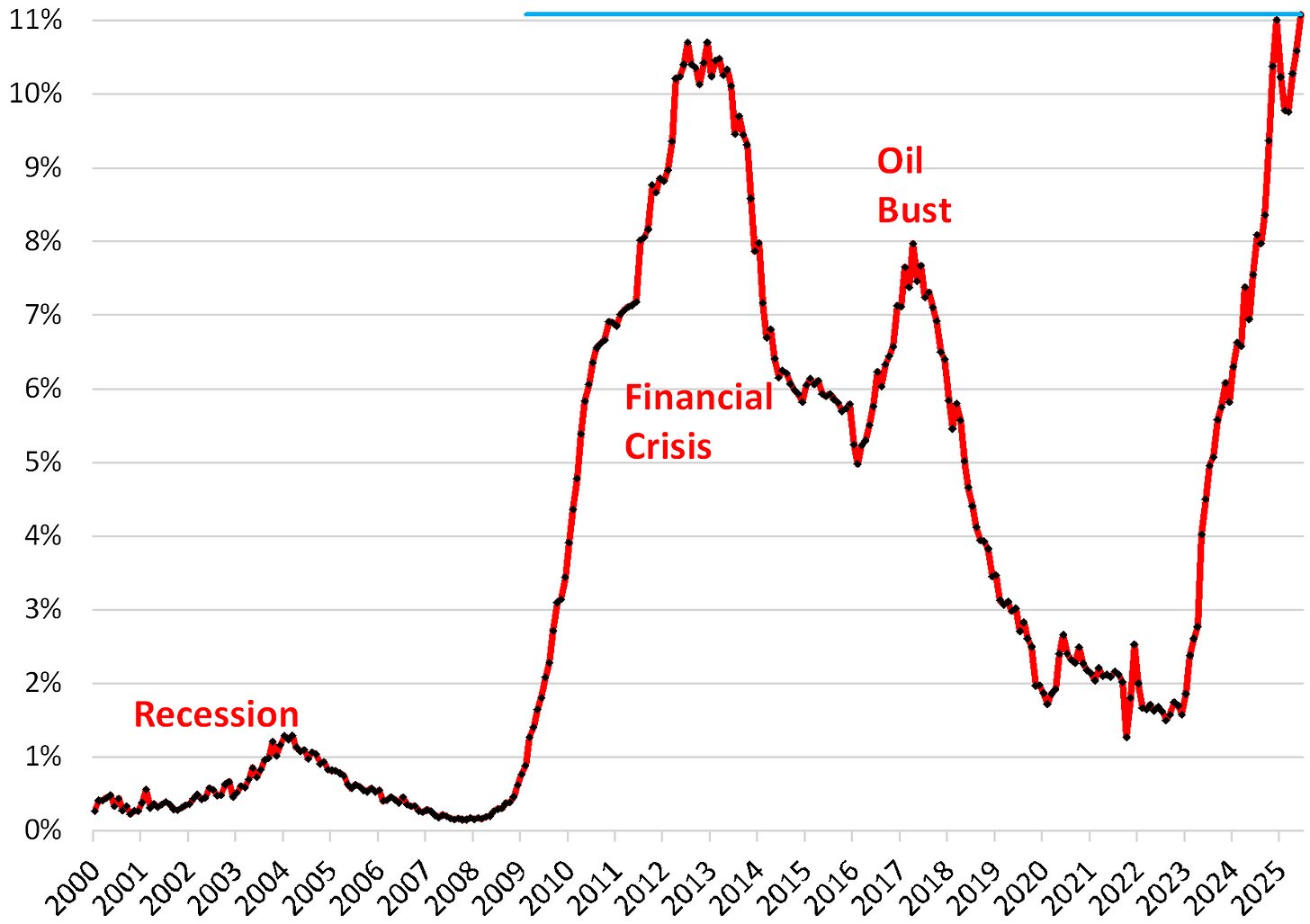

US Office CMBS delinquency rate %

Source: Trepp, WOLFSTREET.com