10k Words | January 2023

Apparently, Confucius did not say “One Picture is Worth Ten Thousand Words” after all. It was an advertisement in a 1920s trade journal for the use of images in ads on the sides of streetcars...

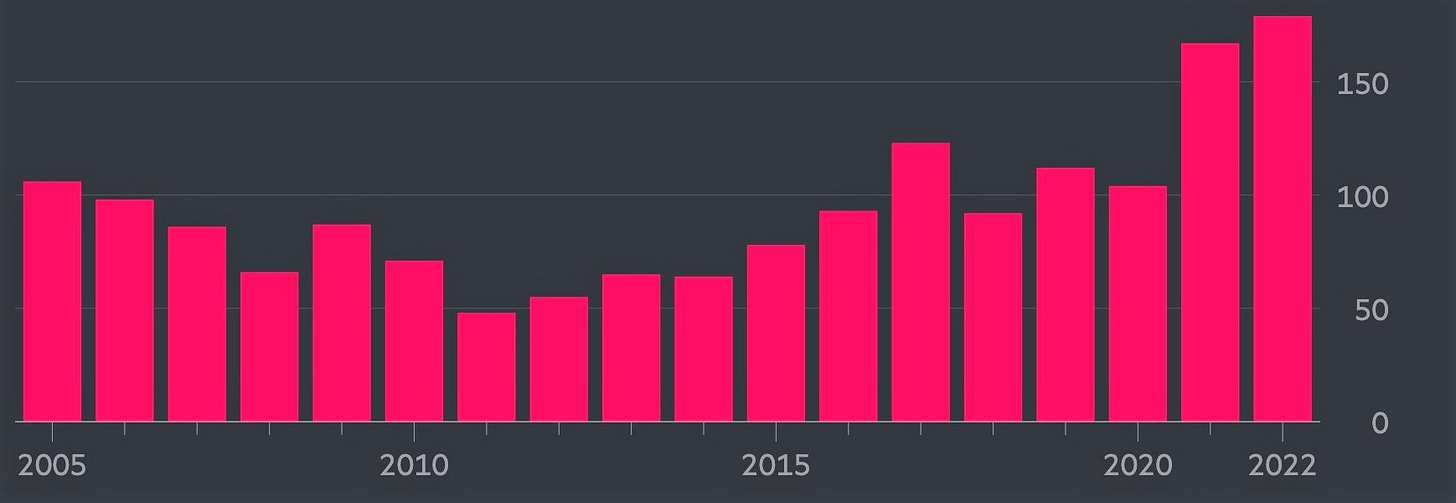

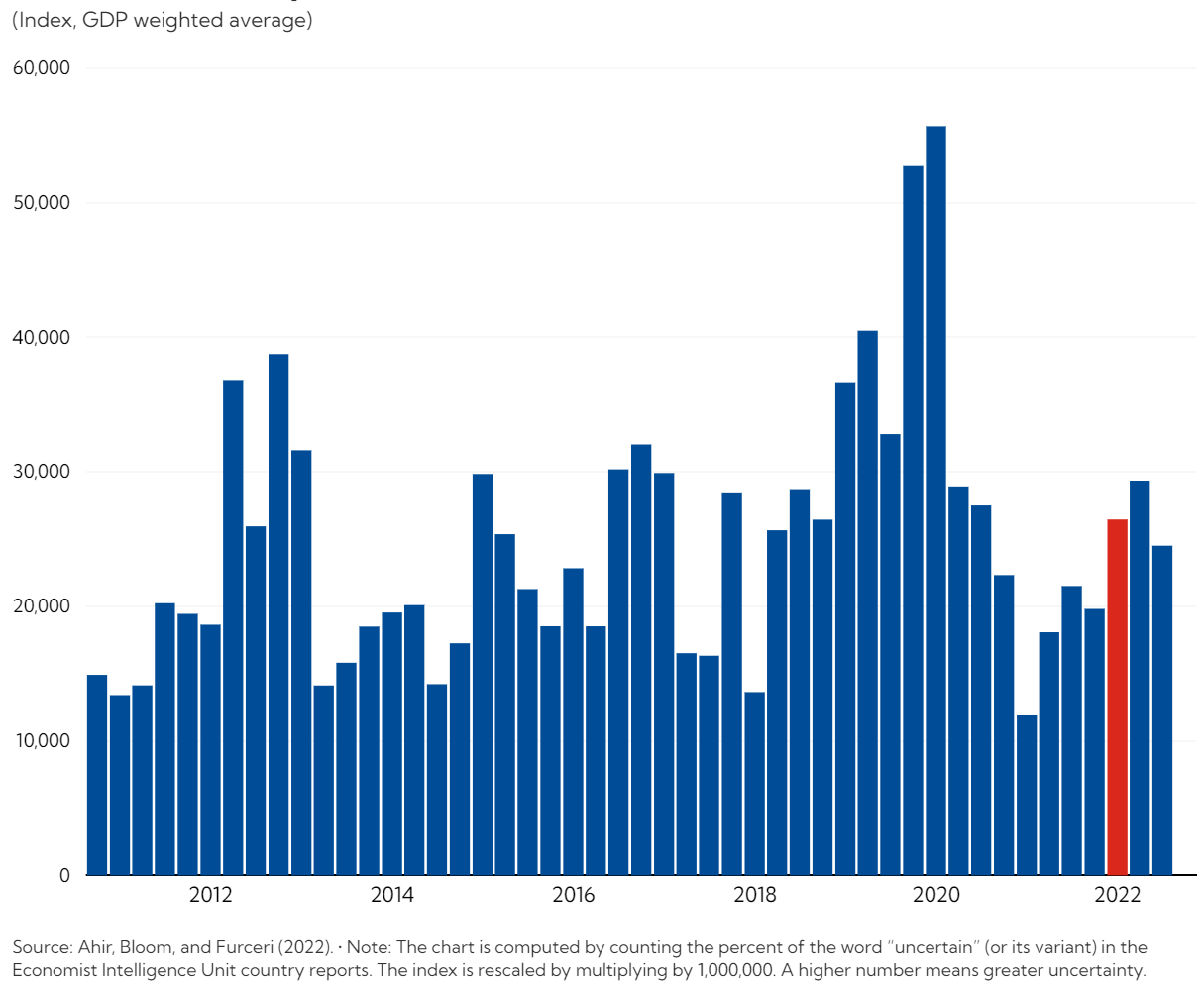

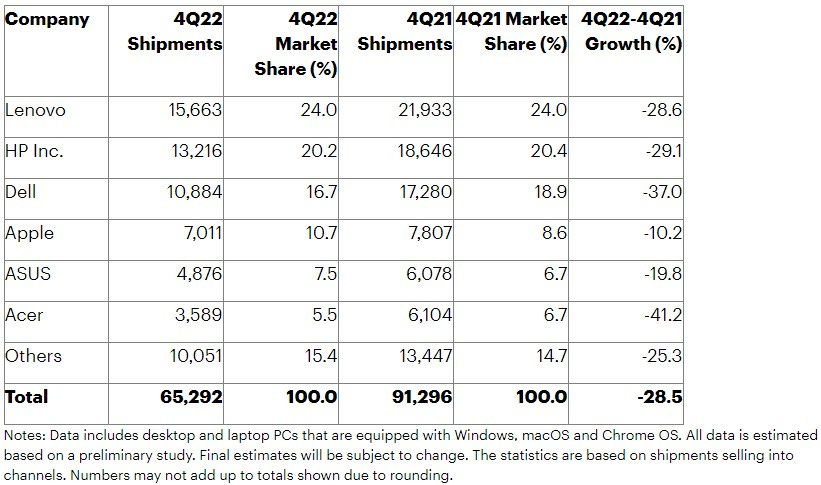

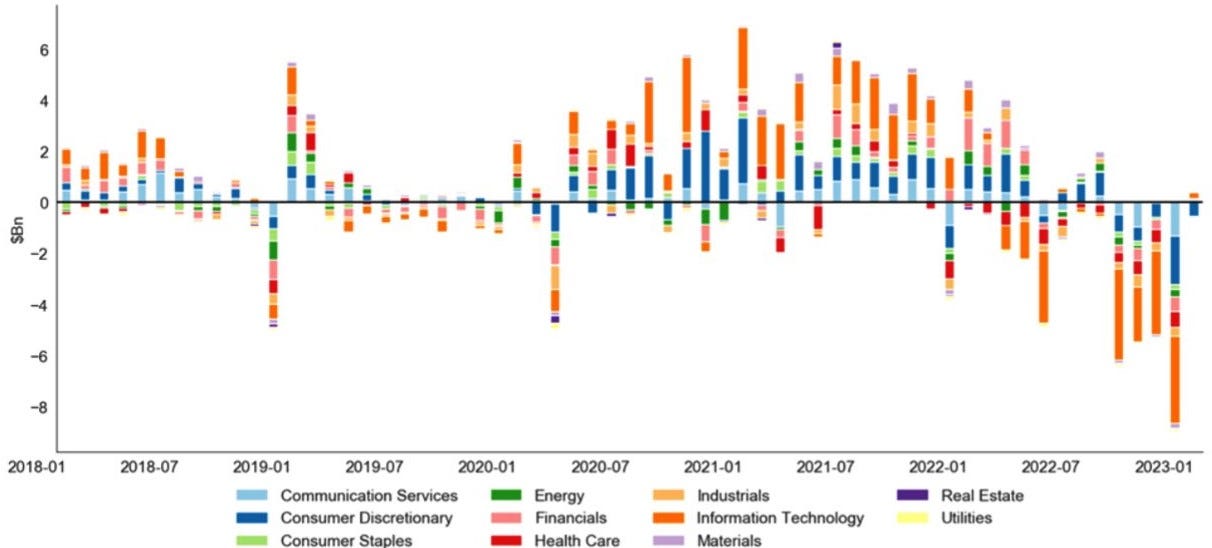

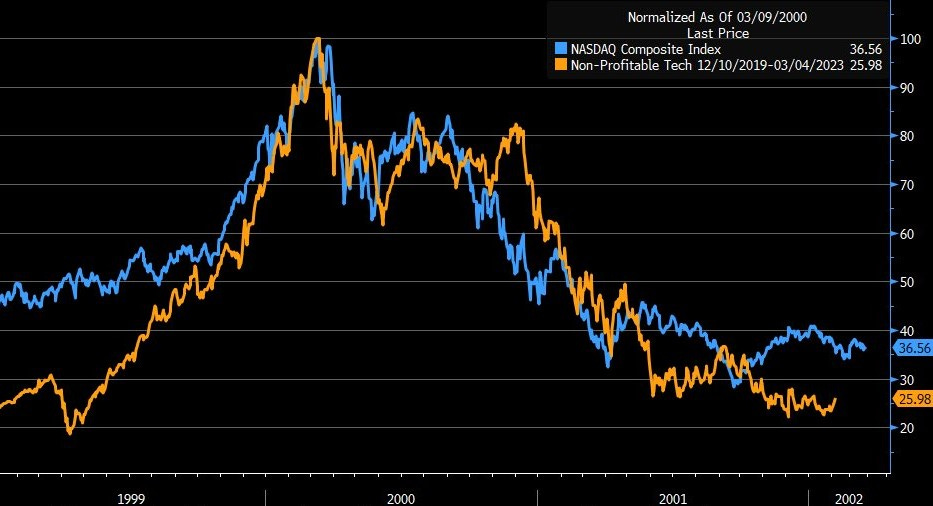

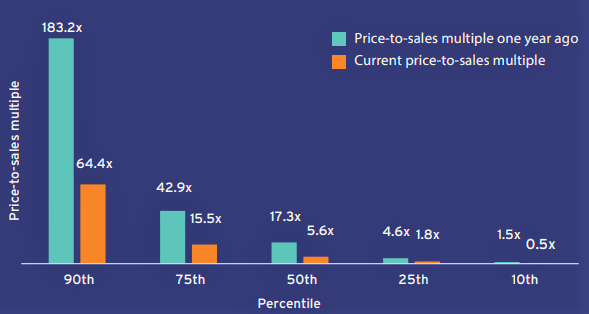

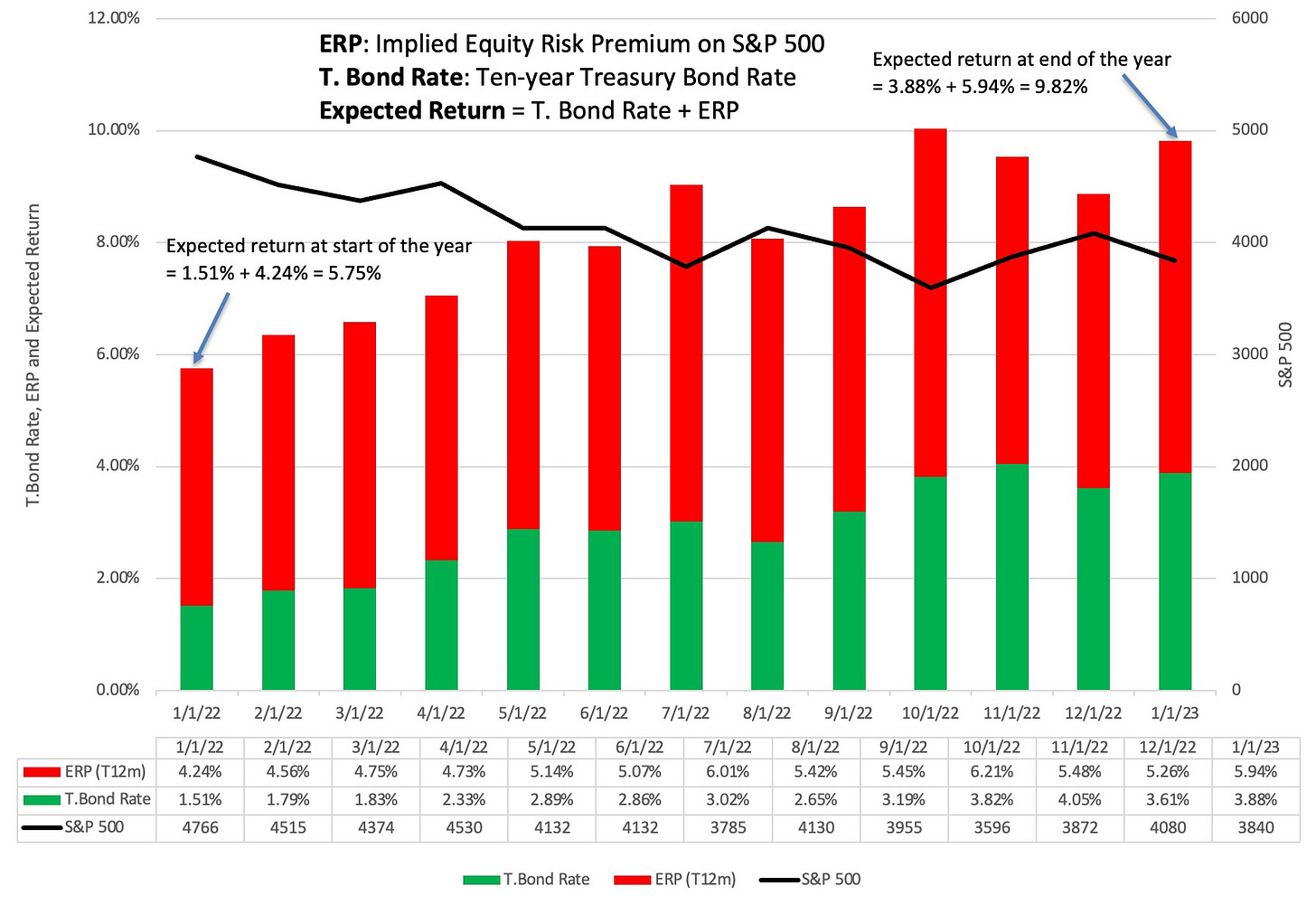

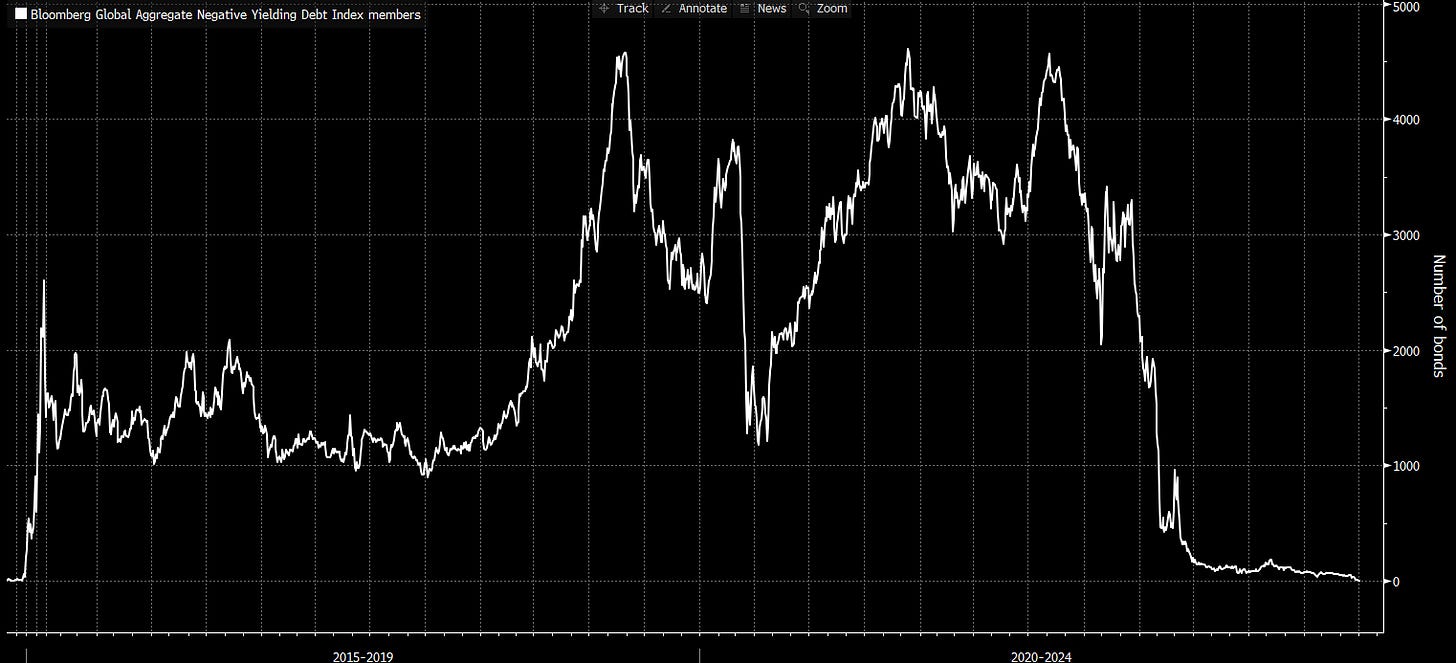

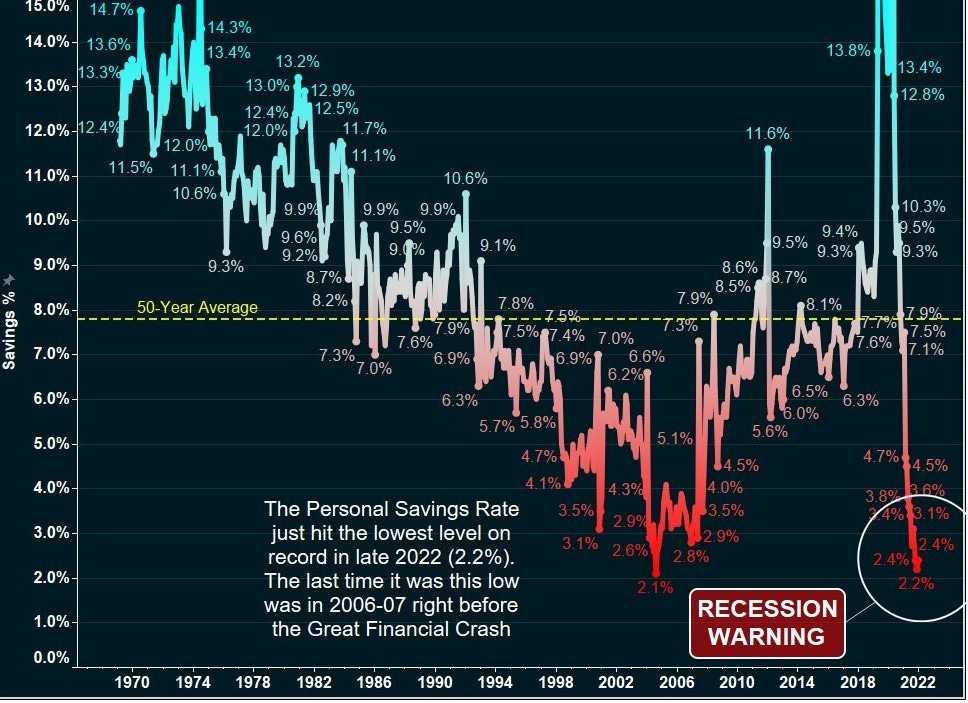

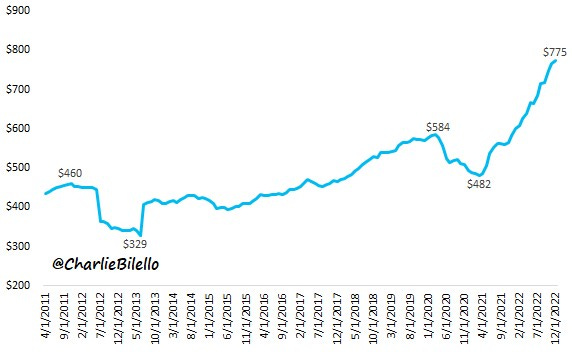

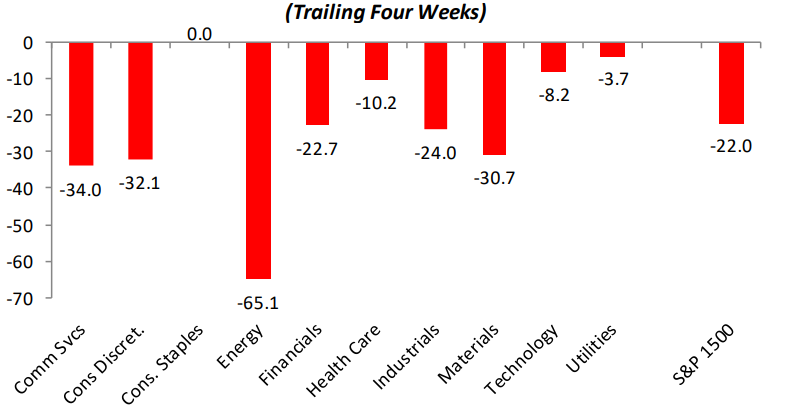

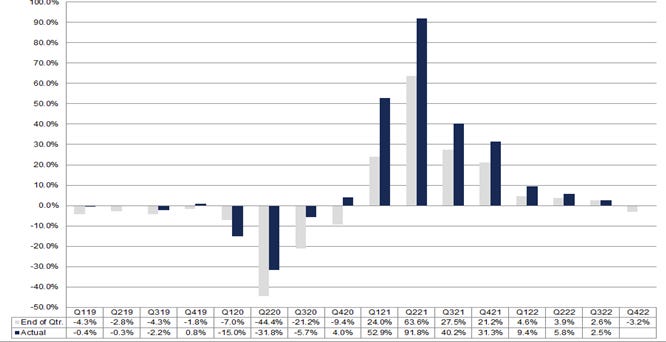

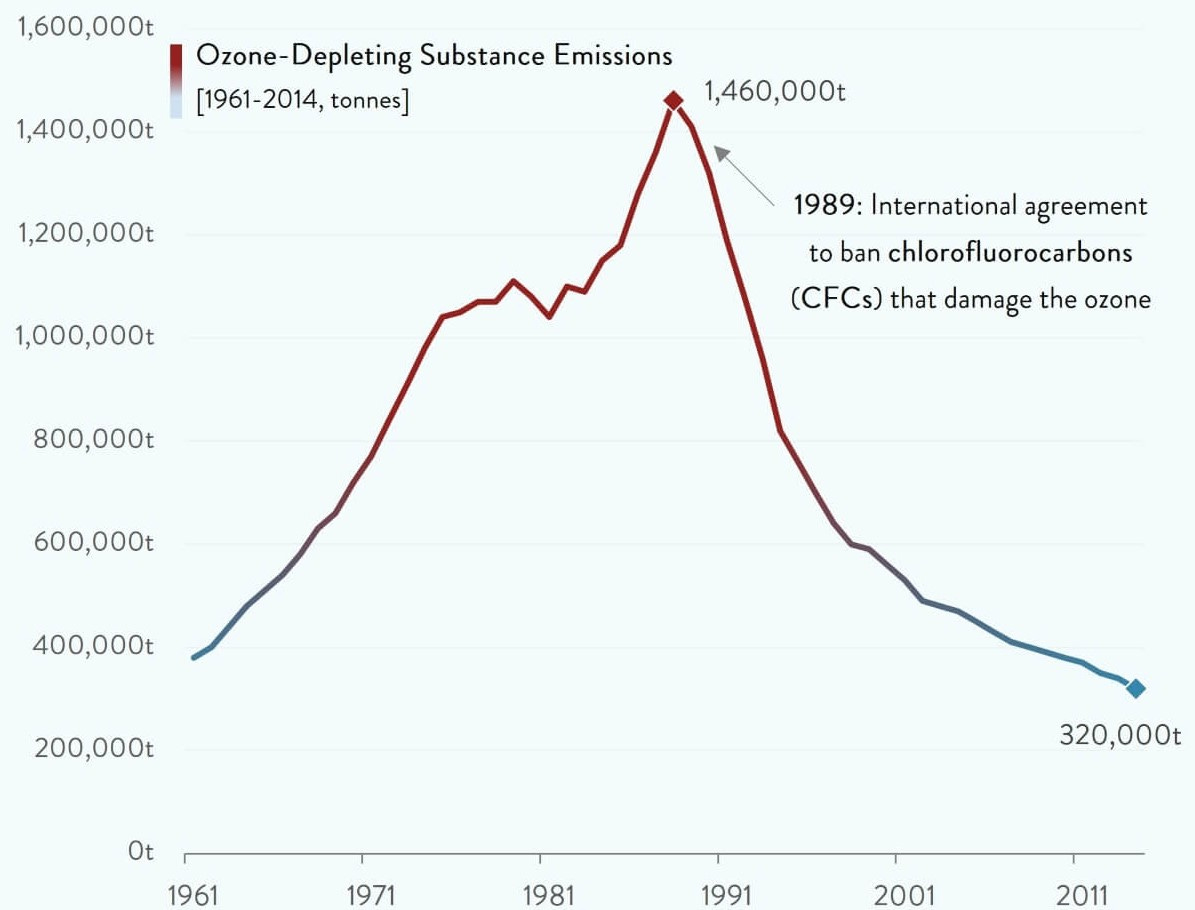

If there was a year in investment markets where swearing was justifiable, 2022 would be a great candidate. The FT shows us swearing reached new heights on company conference calls. Maybe swearing in 2023 will find a new peak as the feeling of greater uncertainty remains - just look at the IMF’s plot. Gartner’s estimate of a 28.5% year-on-year decline in global PC sales may cause a few to swear, at least privately. Net flows into tech, as charted by JP Morgan, were hammered right through to the end of 2022. Of course it was the unprofitable segment of tech that Charles Schwab’s @LizAnnSonders shows taking the most heat. We can also see that pain in the price/sales multiple contraction highlighted by The Macro Compass’ @MacroAlf. There can be no doubt the cost of capital has jumped - Professor Damodaran’s expected equity return estimate has increased >4% while Bloomberg’s negative yield bond chart lost its last member. Two different schools of thought fight it out over what the Fed needs to do to curb inflation - CLSA shows that when US inflation has spiked above 5%, the Fed had to lift rates to “within spitting distance” of the inflation peak; but DoubleLine is backing the bond market’s lower implied rates over the Fed’s expectations. Economist @C_Barraud picked up on the decline in Australian house prices as borrowing costs surge. Credit card rates are surging too, as per FRED data, and re:venture consulting sounded the alarm on personal savings in the US diving. The cost of debt is also a growing problem for governments, @CharlieBilello highlights. Looking forward to reporting season, Bespoke sees market expectations in the US have been pulled back across almost all sectors. FactSet’s aggregate of S&P 500 earnings estimates shows a 3.9% decline is now the consensus for the December quarter - but the actual earnings growth rate has exceeded the estimated earnings growth rate at the end of the quarter in 38 of the past 40 quarters. Finally, some good news - chartr brought to our attention the progressive healing of the ozone layer.

Bull market in swearing - frequency of swearing on conference calls

Source: AlphaSense, Financial Times

World Uncertainty Index - Ukraine invasion spike in red

Source: IMF

Global PC shipments in December quarter of CY2022

Source: Gartner

Thematic net flows split (excluding ETFs)

Source: JP Morgan, @wallstjesus

Performance of non-profitable tech stocks (US)

Source: Charles Schwab’s @LizAnnSonders, Bloomberg

Price-to-sales for VC-backed IPOs (US)

Source: Pitchbook, Morningstar, @macroalf

US Equity Risk Premium

Source: Aswath Damodaran

The last of the negative yielders

Source: Bloomberg

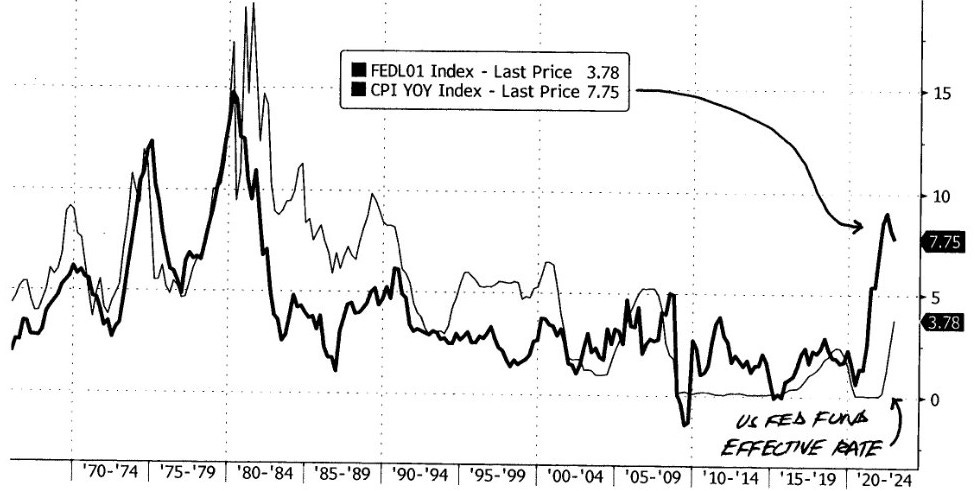

When US inflation has spiked above 5%, Fed Funds Effective Rate has had to follow

Source: CLSA via @nomad_cap

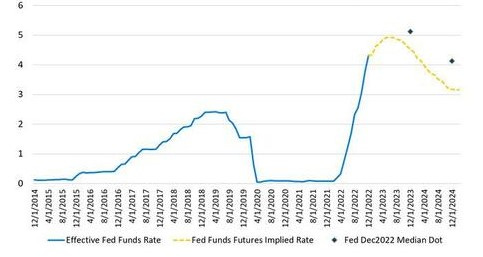

Fed Funds Rate - Market Expectations v Fed Projections

Source: DoubleLine

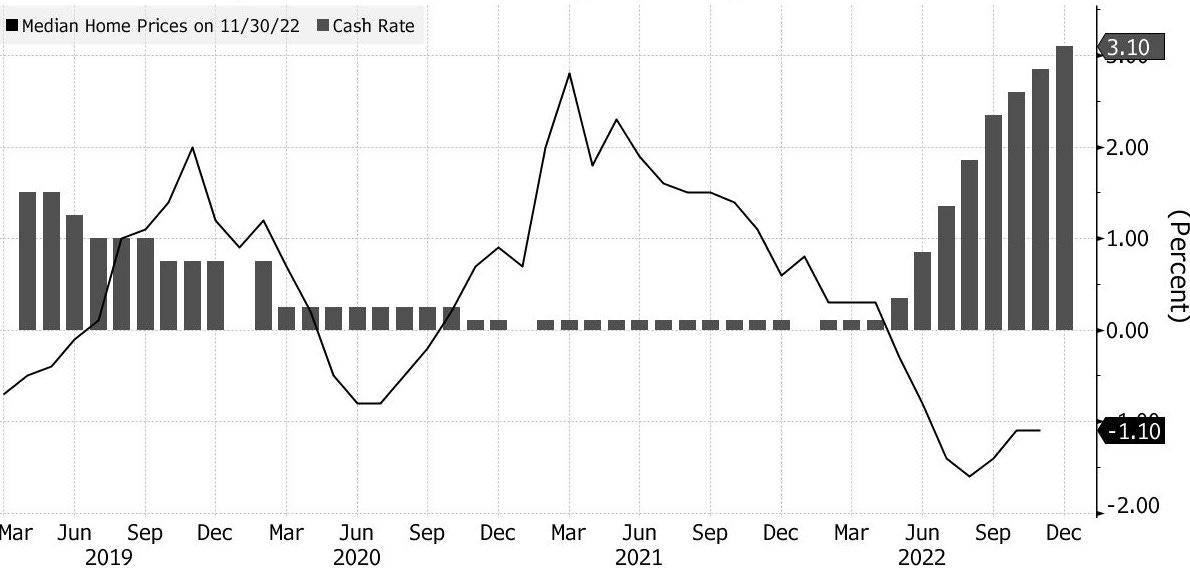

Australian home prices slide as borrowing costs surge

Source: CoreLogic, RBA, @C_Barraud

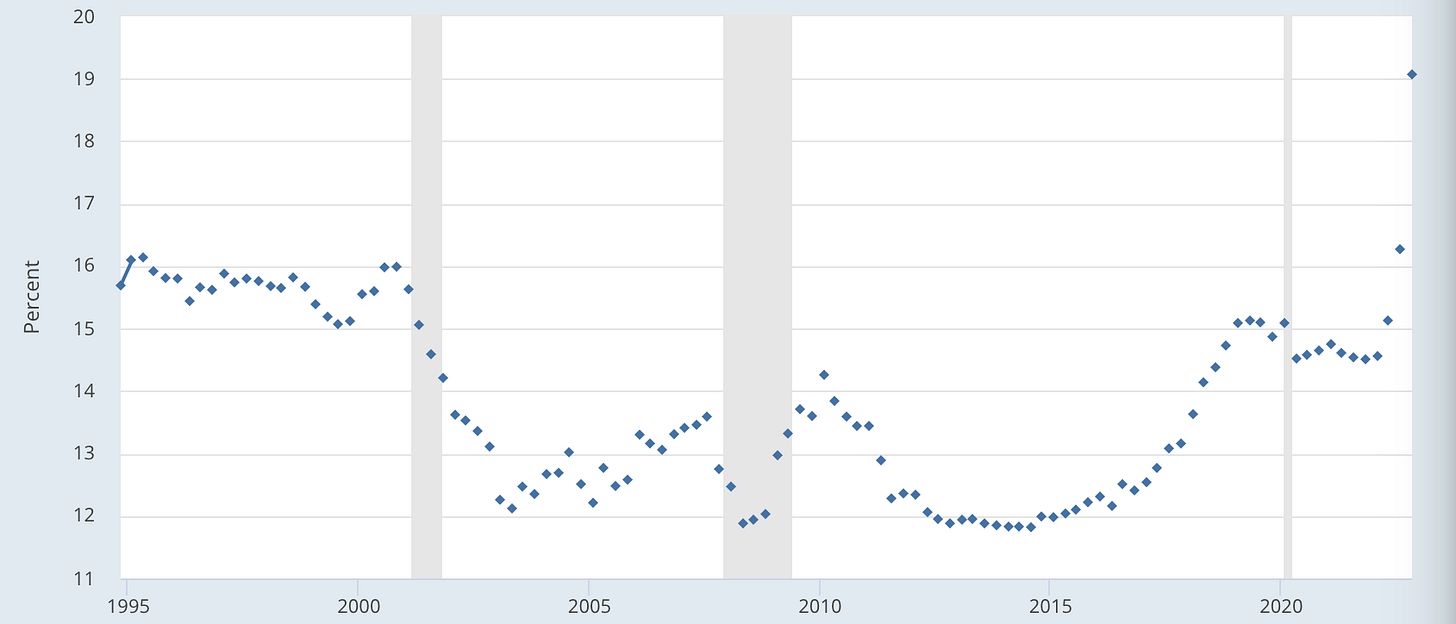

US credit card interest rates surge

Source: FRED, Blockworks

US personal savings rate hit the lowest level on record in late 2022

Source: re:venture consulting

Interest expense on US public debt outstanding

Source: @CharlieBilello

US S&P 1500 EPS revisions by sector - the sptread between positive and negative

Source: Bespoke Investment Group

S&P 500 quarterly earnings growth - estimates and actuals

Source: FactSet

The ozone layer is healing

Source: Hegglin et al, Chartr