10k Words | February 2023

Apparently, Confucius did not say “One Picture is Worth Ten Thousand Words” after all. It was an advertisement in a 1920s trade journal for the use of images in ads on the sides of streetcars...

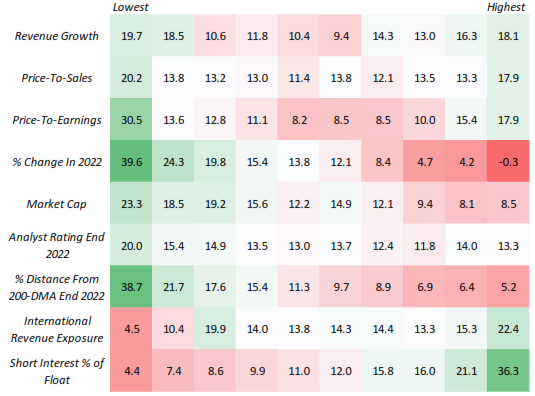

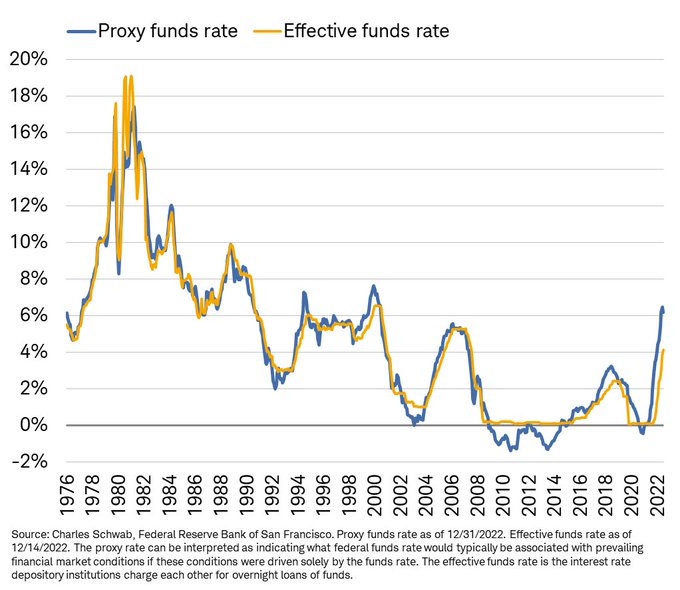

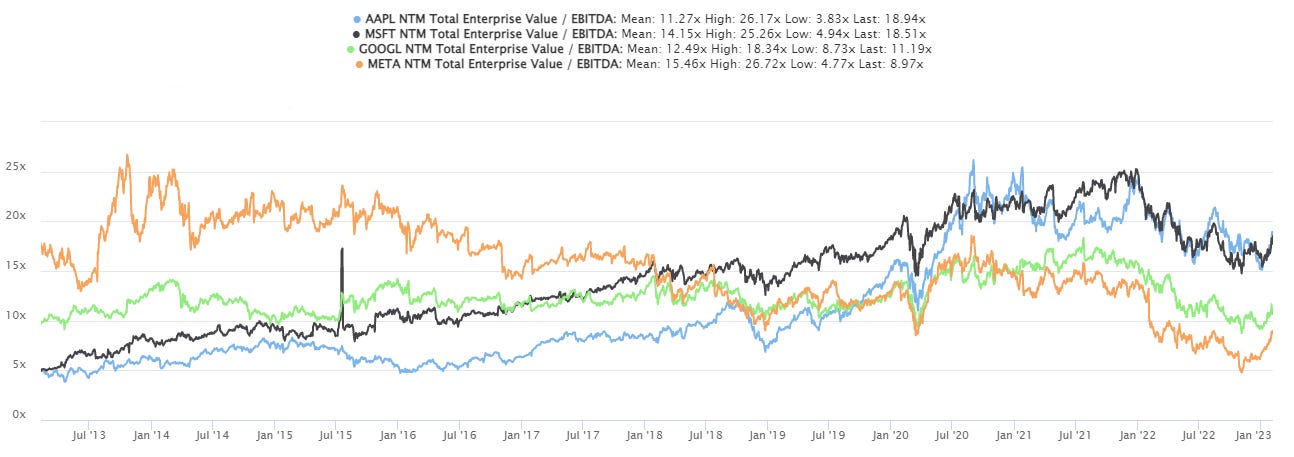

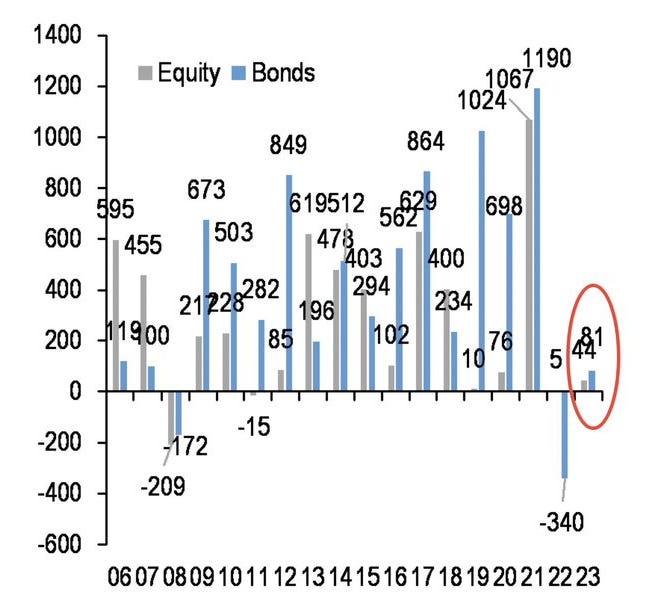

The “US equity market performance this year can broadly be characterised as a dash for trash,” Bespoke declared on Feb 3. Our own analysis of ASX micro-to-mids shows a similar trend - CY2022 losers are now the winners, as are stocks on higher multiples. A case for higher cash rates was charted by Charles Schwab even as Moody’s showed inflation is slowing in some countries. FactSet calculated that the decline in the bottom-up EPS estimate recorded during the first month of the first quarter was larger than the 5, 10 and 20 year averages. This follows S&P 500 Q4 GAAP earnings falling 13% year-over-year, as Creative Planning charted. Behind the earnings, JP Morgan found the strongest consensus for a US recession on record. Folkelore Ventures published data on the tough year that was 2022 for Australian VC. In the tech sector we have Apple & Microsoft trading above their 10-year average EV/EBITDA multiples while Google/Alphabet and Meta/Facebook are now below average. JP Morgan reckons households have been deploying into equity and bond funds in early 2023 after underinvesting in 2022. Crypto assets lost $US1.5 trillion in capitalisation says ARK. Finally, we take a look at corruption hot spots via Statista.

Russell 1000 Decile Analysis: CY2023-to-date % change

Source: Bespoke

ASX Micro-to-Mids - “Financial, Industrial & Technology” (FIT) factor performance in CY2023-to-date

Source: Equitable Investors

Proxy Fed Funds Rate

Source: Charles Schwab

Year-on-year inflation is slowing in some countries

Source: Moody’s

Change in S&P 500 Quarterly EPS: 1st month of quarter

Source: FactSet

S&P 500 As Reported (GAAP) EPS Growth (Year-on-Year %)

Source: Creative Planning. @CharlieBilello

Survey of Professional Forecasters US Recession Probability

Source: Pitchbook, Morningstar, @macroalf

Australian Venture Capital raisings by number and amount

Source: Cut Through Venture, Folkelore Ventures

Forward EV/EVITDA multiples over 10 years for tech leaders

Source: TIKR, Equitable Investors

Global equity & bond fund flows

Source: JP Morgan

~$US1.5 trillion wiped out in crypto market capitalisation in 2022

Source: ARK Investment Management

Perceived public sector corruption in 2022

Source: Statista, Transparency International