10k Words | December 2024

Apparently, Confucius did not say “One Picture is Worth Ten Thousand Words” after all. It was an advertisement in a 1920s trade journal for the use of images in ads on the sides of streetcars...

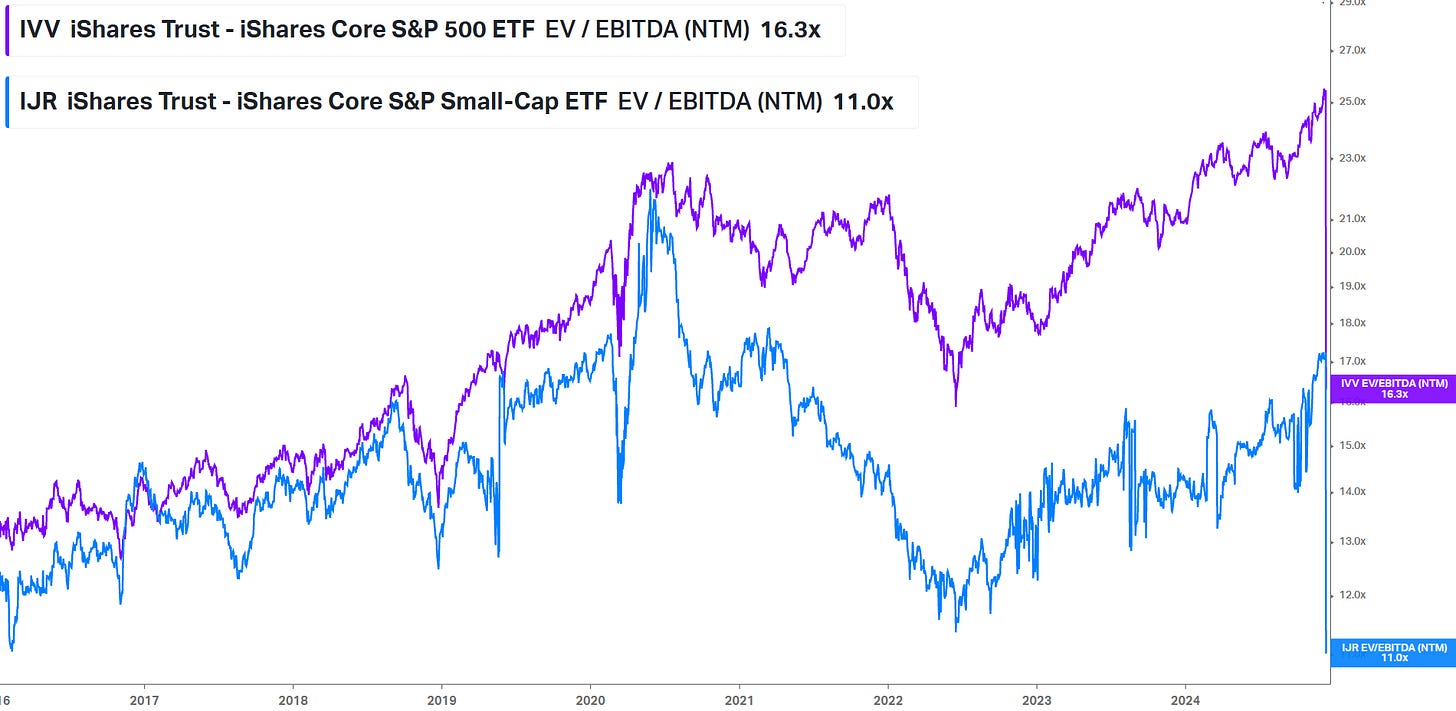

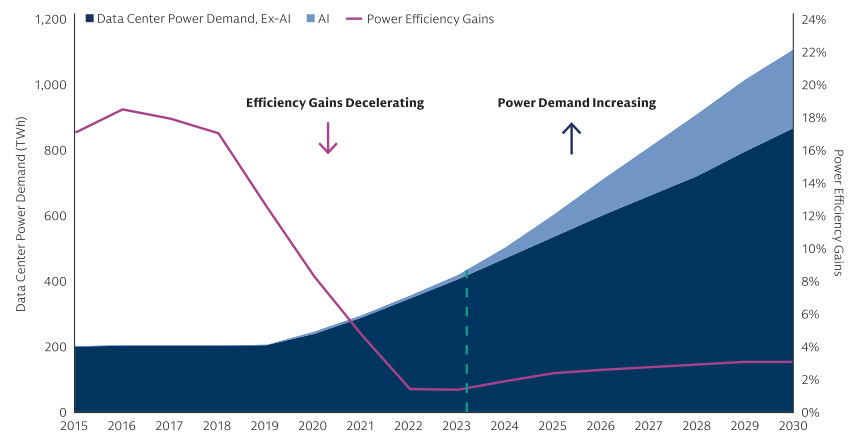

The smallest stocks - "nanocaps" - have had a terrible CY2024 in both the US and Australia. The valuation "jaws" between large and small have dramatically widened since 2020. In Australia trading activity in smaller companies has finally started to recover in 2024. The “Magnificent Seven” have been central to the strong returns and earnings growth for large caps but the rest of the market needs to contribute more going forward. Interestingly, Morningstar’s value analysis indicates the US market remains less overvalued than Australian equities - but it is the UK that looks undervalued. Sentiment indicators remain at extremely positive levels, accompanied by record inflows into US equity funds. Yet private equity is having to hold on for longer. Finally, Goldman charts the data-driven surge in power demand.

CY2024-to-date median US equities performance by industry group and market cap size

Source: GuruFocus

CY2024-to-date median Australian equities performance by industry group and market cap size

Source: GuruFocus

Forward EV/EBITDA of small & large cap US ETF portfolios

Source: Koyfin

Year-on-year change in the value of trade in the S&P/ASX Emerging Companies Index (3m trailing and 12 month trailing values year-on-year)

Source: Iress, Equitable Investors

Earnings growth of the “Magnificent Seven” v. the rest of the S&P 500

Source: JP Morgan Asset Management

Share price performance of the “Magnificent Seven” relative to the S&P 500; small caps v. large caps; value v. growth; defensive v. cyclical; minimal volatility v. the overall market

Source: Barclays

Rolling 6 month correlation between gold and other asset classes

Source: World Gold Council

Price/Earnings varies significantly across regions

Source: Barclays Private Bank

Morningstar fair valuation estimate of the Australian equities market

Source: Morningstar

Morningstar fair valuation estimate of the US equities market

Source: Morningstar

Morningstar fair valuation estimate of UK equities

Source: Morningstar

Percentile of sentiment indicators (data since 2007)

Source: Goldman Sachs

Monthly net flows into US equity funds ($US billion)

Source: EPFR via @RealJimChanos

Share of US buy-out-backed companies by holding period - private equity having to hold longer

Source: Lombard Odier

Data demand growth driving a surge in data centre power use

Source: Goldman Sachs Asset Management